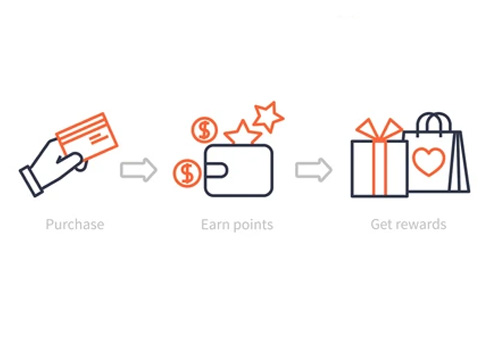

Banks that offer credit cards generally reward their credit card holders with gifts, freebies, discounts and other deals. Reward Programmes encourage customers to use their credit card for bill payments, shopping, dining, travel and more. In return, customers can rack up points and redeem them later for a variety of perks and gifts. Reward points are valued at much lesser than the value actually spent on the credit card, but it is only a perk offered by the bank, and is not a way to earn your money back. But once you have accumulated enough reward points, you can redeem them for air miles, merchandise, cash, gift vouchers, and much more.

How to earn Reward Points:

Each bank offers different methods of earning points. Points earned will vary between different cards based on whether the card is a basic credit card or one that has high priority.

Credit card companies usually offer the following schemes:

Welcome Rewards - Some banks welcome the customer into being a credit cardholder by crediting their rewards accounts with welcome points. You could earn a few thousand reward points from the get go. You can also earn points by spending on your credit card within the first 90 days of card issuance.

- Regular Rewards - For every Rs. 100 you spend on your credit card, you will earn a set number of reward points. This can range from 1 point up to even 10 points or more.

- Accelerated Rewards - You can earn extra points when you spend on special categories such as shopping at partner stores, partner restaurants, other dining expenses, entertainment and so on. For example, if your credit card is travel-oriented, you can earn extra points when you spend on bus tickets, train tickets or flight tickets. If your card is a shopping-oriented card, you might earn extra points on retail purchases.

- High-value Purchases - Spending on purchases that are of high-value such as jewelry, travel bookings, and holidays can fetch more reward points.

- International Rewards - Some credit cards can earn extra points for spending on the card while you’re abroad.

- Bonus Points - You can earn bonus points when you spend a certain amount on your credit card. For example, you earn 1 reward point for every Rs. 100 spent. But you spend Rs. 1.5 lakhs on your credit card in a month. Any more expenditure in the month will earn double the reward points for every Rs. 100 spent.

- Loyalty Points - Credit Card companies also offer rewards upon renewal of your credit card. For your loyalty to the credit card, you can earn a significant sum of points.

- Supplementary Cards - You can avail of supplementary cards for your family members. They should have attained the age of 18 years. Any points earned for spends on this card will be credited to the main credit card’s rewards account.